Contact Options

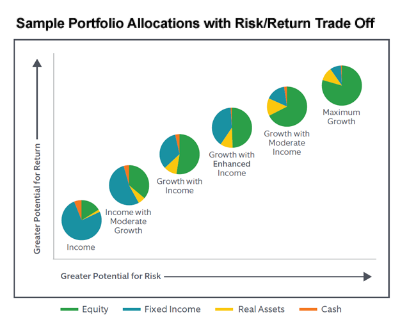

Our asset allocation process seeks to capitalize on short-term opportunities and minimize the effects of market downturns while keeping your portfolio aligned with your long-term objectives, time horizon and tolerance for risk. We'll provide:

- Strategic portfolio frameworks for a range of investor objectives

- Tactical adjustments to take advantage of changing market environments and mitigate risk

- Ongoing monitoring and re-balancing to help keep your portfolio aligned with your goals

- Access to extensive proprietary research and the collective expertise of a world-class investment managed institution

The Diversified Strategist Portfolios offer solutions for 5 investment objectives, along with tax sensitive fulfillment options to help you make the most of your invested assets.

With the Diversified Strategist Portfolios, our focus is on helping investors achieve better outcomes.

For more information, click the Contact Us button or call 1.800.894.6900, option 6

Not FDIC Insured / May Lose Value / Not Financial Institution Guaranteed / Not a Bank Deposit / Not Insured by Any Federal Government Agency